Social Security

Table of contents

Employment Patterns and Social Security

Instead of climbing the ranks in the same company for 30 years, workers today often have two or more part-time jobs at the same time sometimes also in combination with self-employment. Periods of continuing education and also leisure activities are allocated more space in a person’s biography and often run parallel to their professional life, all of which is becoming ever more feasible by working flexible hours at home.

Social insurance contributions, however, are still pegged to the pattern of continuous full-time earning - i.e. ALV unemployment insurance cover is based on a working person’s own contributions, the sum of which reduces with part-time work, gaps in employment, and atypical forms of paid activity.

Especially women, who are more likely to work part-time due to unpaid family commitments, receive up to three times less pension during their retirement than men who, mostly relieved of unpaid family work, are more likely to work full-time and are often financially better off in old age.

A private pension plan in the form of a third pillar or an alternative financial investment reduce the risk of poverty in old age. There is also the possibility of supplementing your pension with voluntary contributions into your own pension fund.

Coordination Deduction

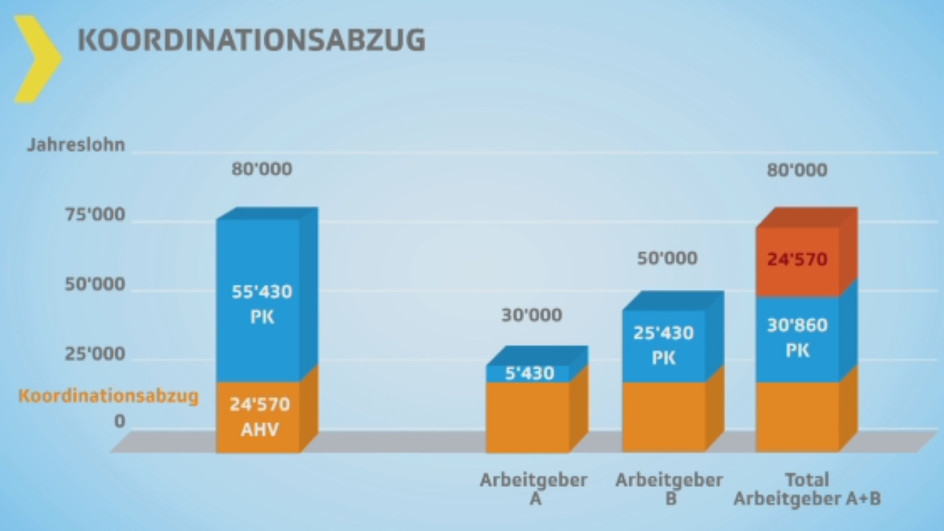

Students generally work part-time, and often for different employers at the same time. However, what many people don’t know is that although the total salary level is the same, two part-time jobs lead to lower second pillar pension savings than one job with the same employer. The reason for this is the coordination deduction (you can find the current annual amount here).

The coordination deduction is made from the gross salary. This is the part that is already insured with the AHV (old-age and survivors' insurance). The employer(s) must insure the remaining amount with the pension fund.

In the case or two or more employment relationships, the coordination deduction may in certain circumstances be made twice from the gross salary. Some pension funds reduce the coordination deduction or adjust it to the worker’s employment level. It is however important to check this before accepting one (or several) part-time positions. Part-time employees should request the main employer’s pension fund to co-insure the parallel income. Provided the pension fund regulations allow, this will work. In this case, the coordination deduction is only made once.

If according to the regulations of the main employer’s pension fund it is not obliged to co-insure the parallel income, the employee can contact the Substitute Occupational Benefit Institution BVG which is obliged to insure the total salary. Hence, part-time employees can optimize their insurance cover. The institution will also claim employer contributions from the employer to avoid any gaps.

For specific legal advice please contact the

Substitute Occupational Benefit Institution BVG: www.chaeis.net

Further information is available online at Beobachter